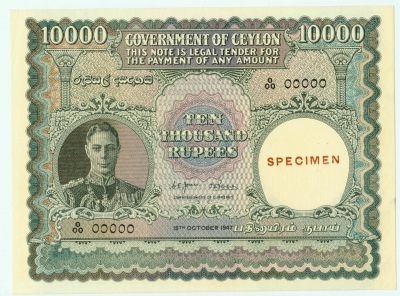

Why is the clause ‘I promise to pay’ written on the bank notes?

Ever noticed a small clause written on our banknotes? If you haven’t, take a close look at it. It is the promissory note, along with the signature of the RBI Governor.

Ever noticed a small clause written on our banknotes? If you haven’t, take a close look at it. It is the promissory note, along with the signature of the RBI Governor.Let’s take an example. The promissory clause printed on the banknotes that read as ‘I promise to pay the bearer the sum of one hundred Rupees’ means that the banknote with you is a legal tender for the given amount. It is also the promise made by the Governor of the central bank.

The clause acts as a written guarantee made by the bank regarding the genuineness of note, and its value. It is invariably seen on all banknotes printed in the country.

The Reserve Bank of India was founded on April 1, 1935, constituted under the Reserve Bank of India Act 1934. It was a shareholder’s bank then, and remained so until its nationalization in 1949. It has been fully owned by the Indian government ever since.

The Reserve Bank of India was founded on April 1, 1935, constituted under the Reserve Bank of India Act 1934. It was a shareholder’s bank then, and remained so until its nationalization in 1949. It has been fully owned by the Indian government ever since.

The Reserve Bank of India has the sole right to produce currency notes of all denominations in the country. Other than this, it has many other functions.

The Reserve Bank of India has the sole right to produce currency notes of all denominations in the country. Other than this, it has many other functions. Yes, it is the Reserve Bank of India that issues banknotes needed for the country. But have you ever wondered on what basis they issue the currency notes? Most certainly, on a demand-basis.

Yes, it is the Reserve Bank of India that issues banknotes needed for the country. But have you ever wondered on what basis they issue the currency notes? Most certainly, on a demand-basis. Broadly, the Indian banking sector can be divided into two types of banks- scheduled and non-scheduled.

Broadly, the Indian banking sector can be divided into two types of banks- scheduled and non-scheduled. Until the 1960s, all banks except the State Bank of India remained under the ownership and management of private persons. By then, banks had become an important tool for the development of economy.

Until the 1960s, all banks except the State Bank of India remained under the ownership and management of private persons. By then, banks had become an important tool for the development of economy. In its literal sense, ‘liberalization’ means relaxation of restrictions or regulations. It was a policy adopted in our country almost two decades ago. It was introduced in the 1990s in our banking sector too. Manmohan Singh was the finance minister then. So, what exactly did this process mean?

In its literal sense, ‘liberalization’ means relaxation of restrictions or regulations. It was a policy adopted in our country almost two decades ago. It was introduced in the 1990s in our banking sector too. Manmohan Singh was the finance minister then. So, what exactly did this process mean?

Negotiable instruments are those that can be converted into liquid cash under certain conditions like that of a cheque.

Negotiable instruments are those that can be converted into liquid cash under certain conditions like that of a cheque. This concept surely seems familiar to all of us, as it is now filling newspapers and newsrooms across the country.

This concept surely seems familiar to all of us, as it is now filling newspapers and newsrooms across the country.

Australia is a country that once successfully demonetized its currency. In 1996, the country replaced its banknotes with their plastic or polymer equivalents. The move was intended to fight financial malpractices that were growing rampant.

Australia is a country that once successfully demonetized its currency. In 1996, the country replaced its banknotes with their plastic or polymer equivalents. The move was intended to fight financial malpractices that were growing rampant.